estate tax unified credit amount 2021

The estate of a New York State resident must file a New York State estate tax return if the following. See section 6166i for more information.

U S Estate Tax For Canadians Manulife Investment Management

Child Tax Credit.

. Business Tax Forms and Publications for 2022 Tax Filing Season Tax Year 2021 Qualified High-Tech Companies Tax Forms. The tax is then reduced by the available unified credit. The federal estate tax kicks in for estates that are worth more than 117 million in 2021 and 1206 million in 2022 the same amounts as the lifetime gift tax exemption.

The 2022 exemption is 1206 million up from 117 million in 2021. The unified credit is 345800 and an estate tax return is not required to be filed if the decedents gross estate does not exceed 1000000. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022.

1977 Quarters 1 and 2 30000. It is a transfer tax not an income tax. The other part of the.

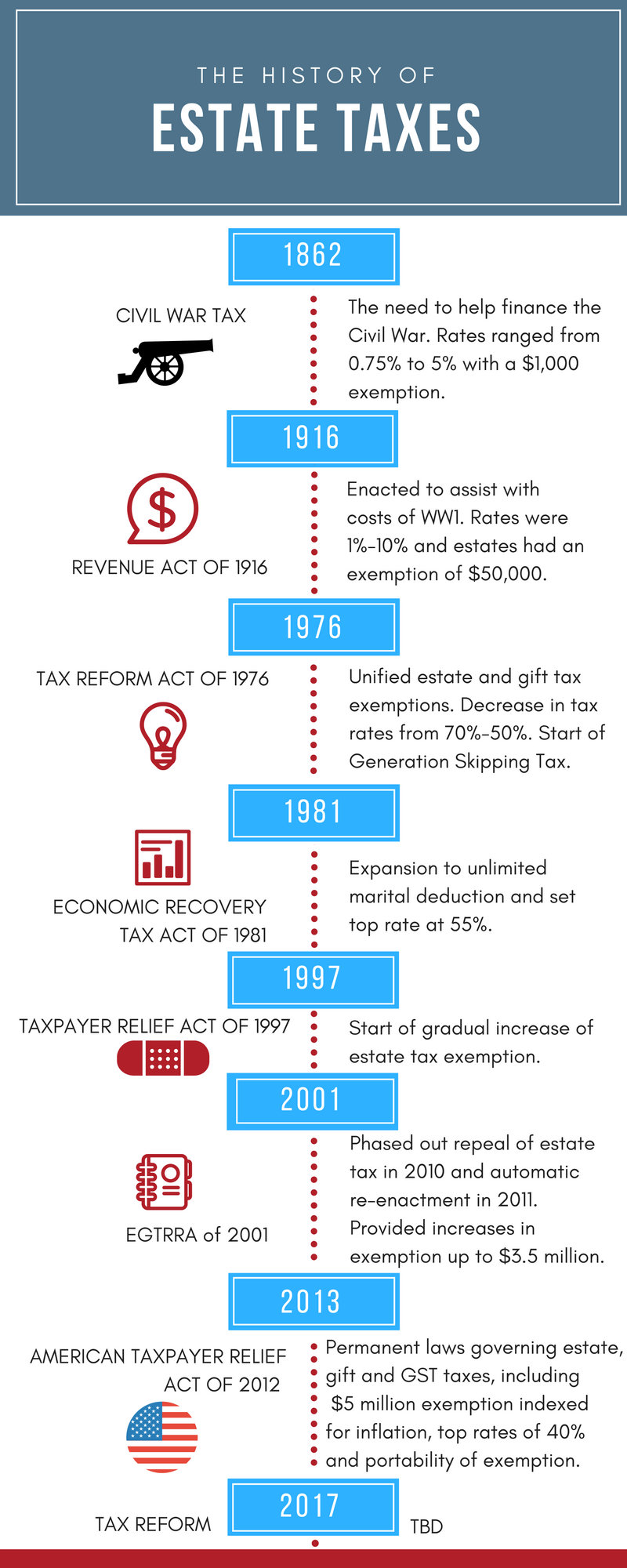

The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year. 1977 Quarters 3 and 4 120667. The estate and gift taxes for example have shared a unified rate schedule since they were combined in 1976 and given the name Unified Transfer Tax.

Notable Ranking Changes in this Years Index Florida. Ranging from the federal estate tax exemption amount or 534 million indexed for inflation. Improving Lives Through Smart Tax Policy.

The unified credit is equal to The amount that can be excluded for decedents dying on or after January 1 2019 is 50 million. Certain GST taxes may be deferred as well. The federal estate tax exemption is transferable between spouses meaning that if the second spouse in a married couple dies in 2022 their estate can effectively have a 24.

Credit Equivalent at 2021 Rates. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections. 2000 BO tax credit for each qualified position created with annual wagesbenefits of 40000 or less.

In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. The Maryland Estate Tax-Unified Credit Act altered the unified credit used for determining the amount that can be excluded for Maryland estate tax purposes. A tax credit that is afforded to every man woman and child in America by the IRS.

Ordinary monetary and property gifts are unlikely to be impacted by this tax since the yearly limit for 2021 is. Possess a current state unified business identifier UBI number. January 1 2020 through December 31 2020.

It also served to reunify the estate tax credit aka exemption equivalent with the federal gift tax credit aka exemption equivalent. The first 1206 million of your estate is therefore exempt from taxation. Formerly Unified Credit Amount.

Currently its a 1000 nonrefundable. The estate tax is part of the federal unified gift and estate tax in the United States. This credit allows each person to gift a.

The amount of the nonresidents federal gross estate plus the amount of any includible gifts exceeds the basic exclusion amount. 2021 through December 31 2021. Floridas corporate income tax rate declined from 55 to 44458 percent in September 2019 effective for tax years 2019-2021.

Is added to this number and the tax is computed. The amount of credit you claim during a reporting period cannot be more than the amount of your BO tax and PUT owed during that period. -Tax year-Your exact refund amount.

This is the maximum amount of estate tax that may be paid in installments under section 6166. Unified Tax Credit. Get information on how the estate tax may apply to your taxable estate at your death.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

A Guide To Estate Taxes Mass Gov

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Exploring The Estate Tax Part 2 Journal Of Accountancy

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

A Taxing Matter For Family Businesses Mercer Capital

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Warshaw Burstein Llp 2022 Trust And Estates Updates

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

A Brief History Of Estate Gift Taxes

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services